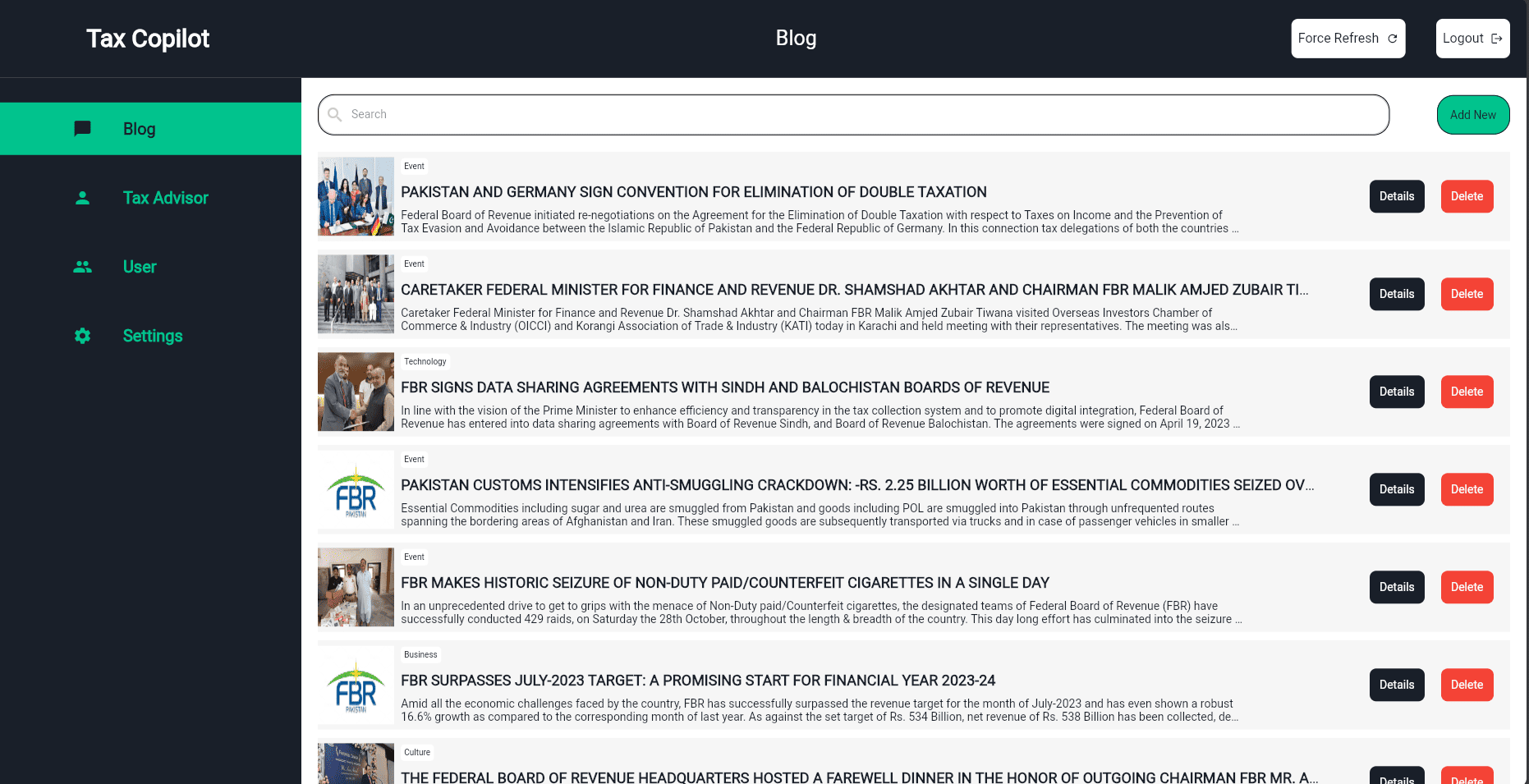

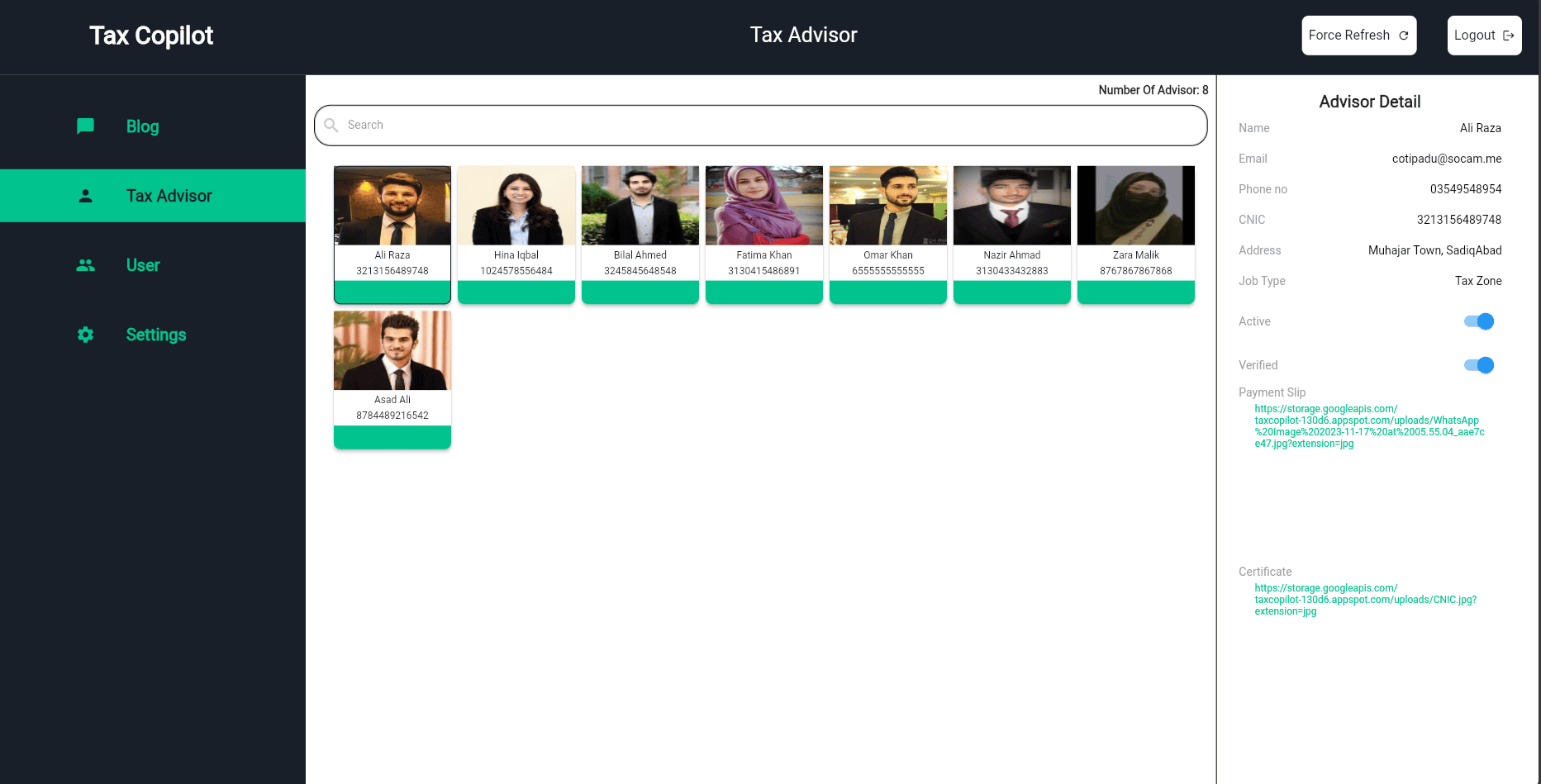

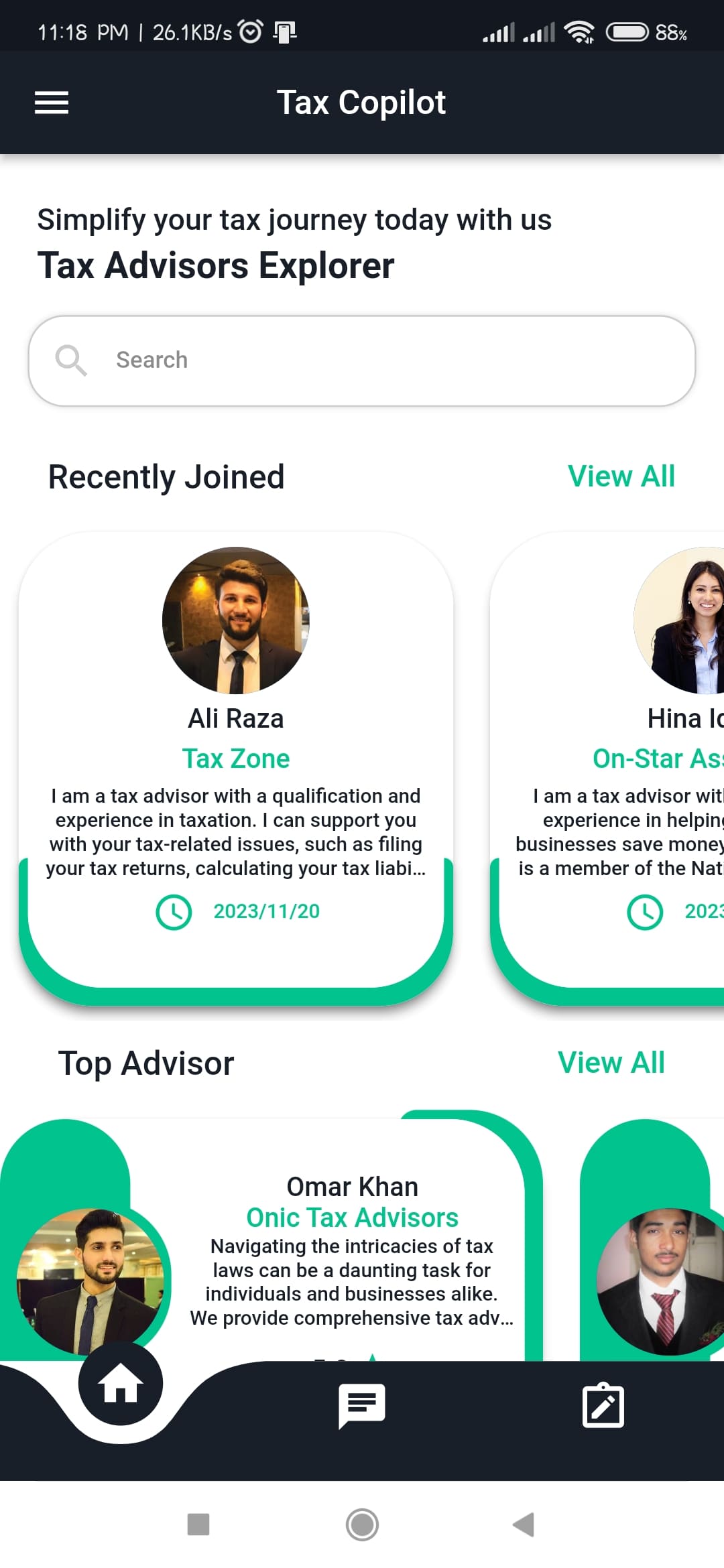

Tax Copilot is a project that offers a platform for tax advisors and their clients. It is built with the Flutter framework on the web, mobile, and desktop platforms for its complete operation. It aims to address the communication and management issues that arise from using WhatsApp and email, which require manual saving of files for each client. With Tax Copilot, clients can easily find verified tax advisors and communicate with them about their taxation. Tax advisors can also manage their clients and their files in one place. This project demonstrates how to create software for a new market that lacks technology in Pakistan.

Objectives

The main objectives of our system are as follows:

1). To provide a platform for tax advisors and their clients to communicate and manage their taxation needs in an efficient and convenient way.

2). To use the flutter framework to demonstrate the capability to create a web, mobile and desktop application that offers various features such as sending messages and documents, document scanning, etc.

3). To solve the problems that arise from using WhatsApp and email, which require manual saving of files for each client.

4). To create software for a new market that lacks technological innovation in Pakistan.

Socio-Economic Benefit

The Tax Copilot project has the potential to generate significant social and economic benefits for Pakistan.

1). Improved tax compliance: The Tax Copilot platform can make it easier for taxpayers to comply with tax laws by providing them with a centralized location to access tax information, file returns, and communicate with tax advisors. This can lead to increased tax revenue for the government, which can be used to fund essential public services such as education, healthcare, and infrastructure.

2). Increased access to tax advice: The Tax Copilot platform can provide small businesses and self-employed individuals with easier access to tax advice from qualified professionals. This can help them to make informed decisions about their taxes and avoid penalties.

3). Reduced financial stress: Tax filing can be a stressful and time-consuming process for many people. The Tax Copilot platform can help streamline the process and make it more efficient, which can reduce financial stress and improve the overall well-being of taxpayers.

4). Creating jobs: The development and operation of the Tax Copilot platform will create jobs in the IT and software development sectors. This can contribute to economic growth and poverty reduction.

Methodologies

Firstly, we started with the personal survey from tax advisors to get the initial requirements and issues involved in the existing system. Then we write a letter to some of the tax bar associations to discuss this project. After that, we refined the requirements further and started planning the project using the following methodologies:

To achieve its goals, the Tax Copilot project used a range of techniques. Among these approaches were:

1). Agile methodology: The project was created with the Agile methodology, which is an iterative and incremental approach to software development. This process enabled the team to quickly adjust to changes and produce functional software on schedule.

2). Rapid prototyping: Early versions of the Tax Copilot platform were created and tested using rapid prototyping. This enabled the team to immediately gather user feedback and iterate on the design.

3). Continuous integration and continuous delivery (CI/CD): CI/CD was utilized to automate the Tax Copilot platform's build, testing, and deployment. As a result, the platform was always up-to-date and bug-free.

Outcome

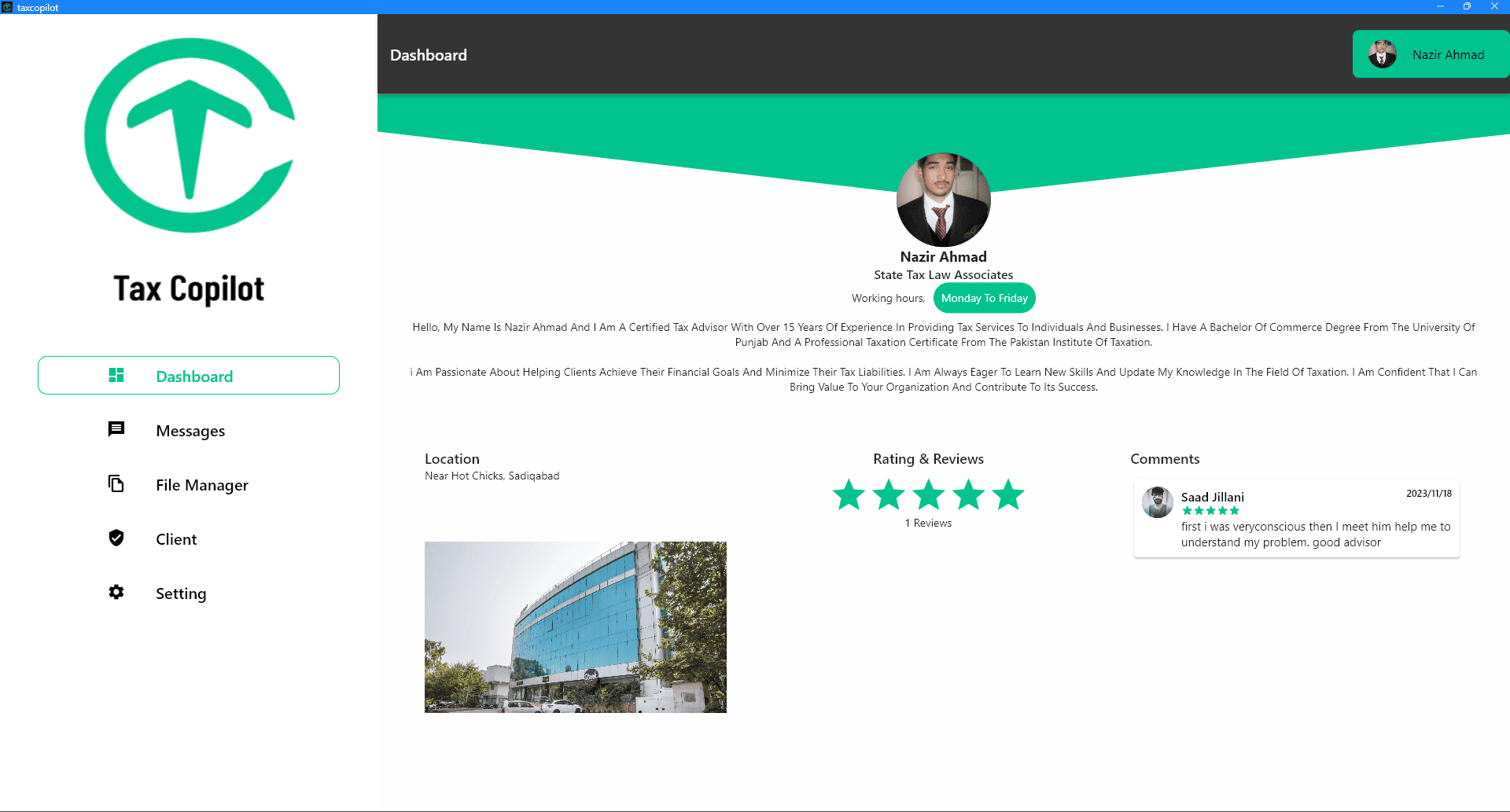

Tax Copilot is designed to streamline communication and file management between tax advisors and clients. The platform is built using the Flutter framework and is available on web, mobile, and desktop platforms.

The platform offers a number of features that are designed to improve the tax advisory process, including:

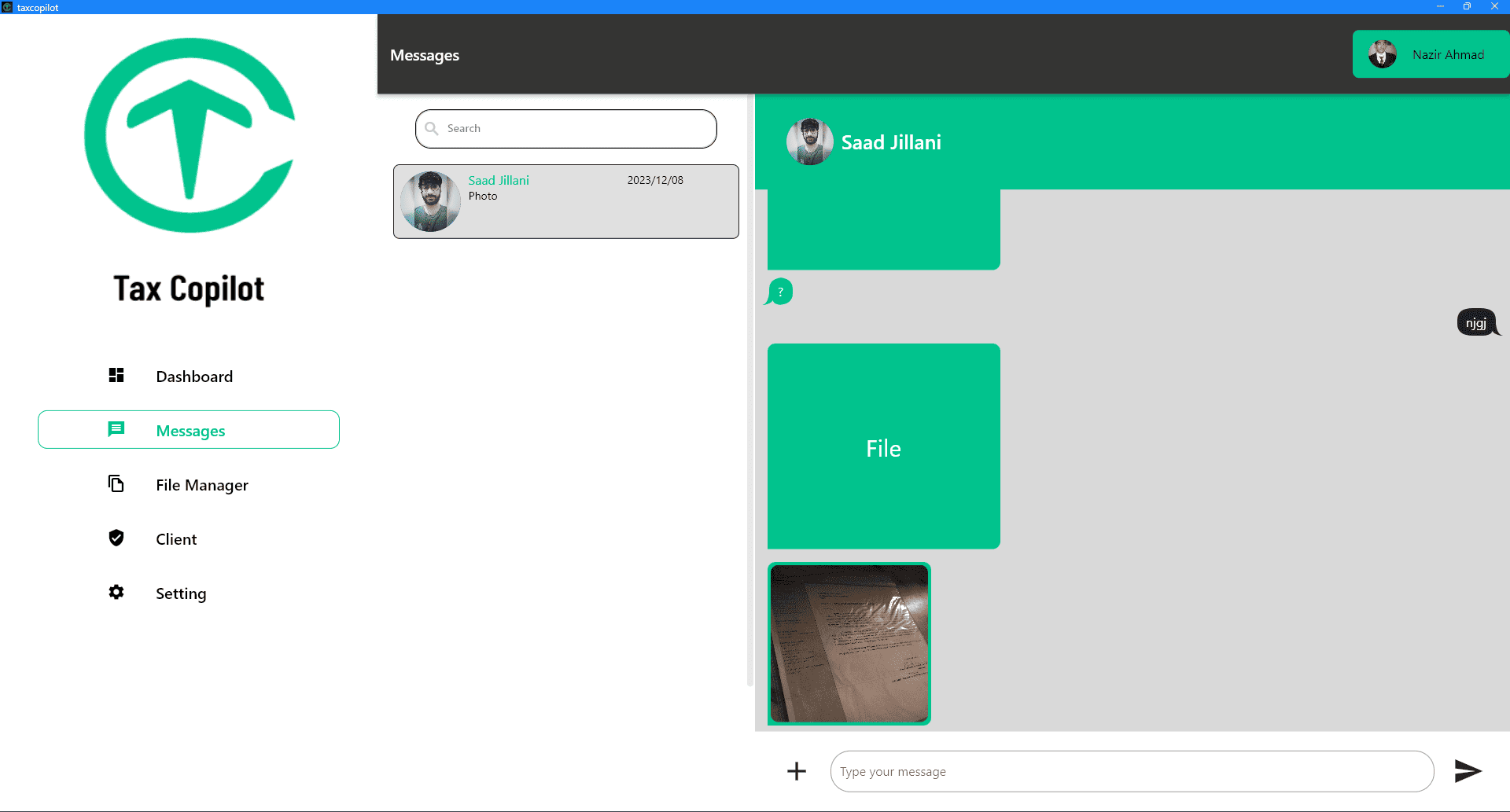

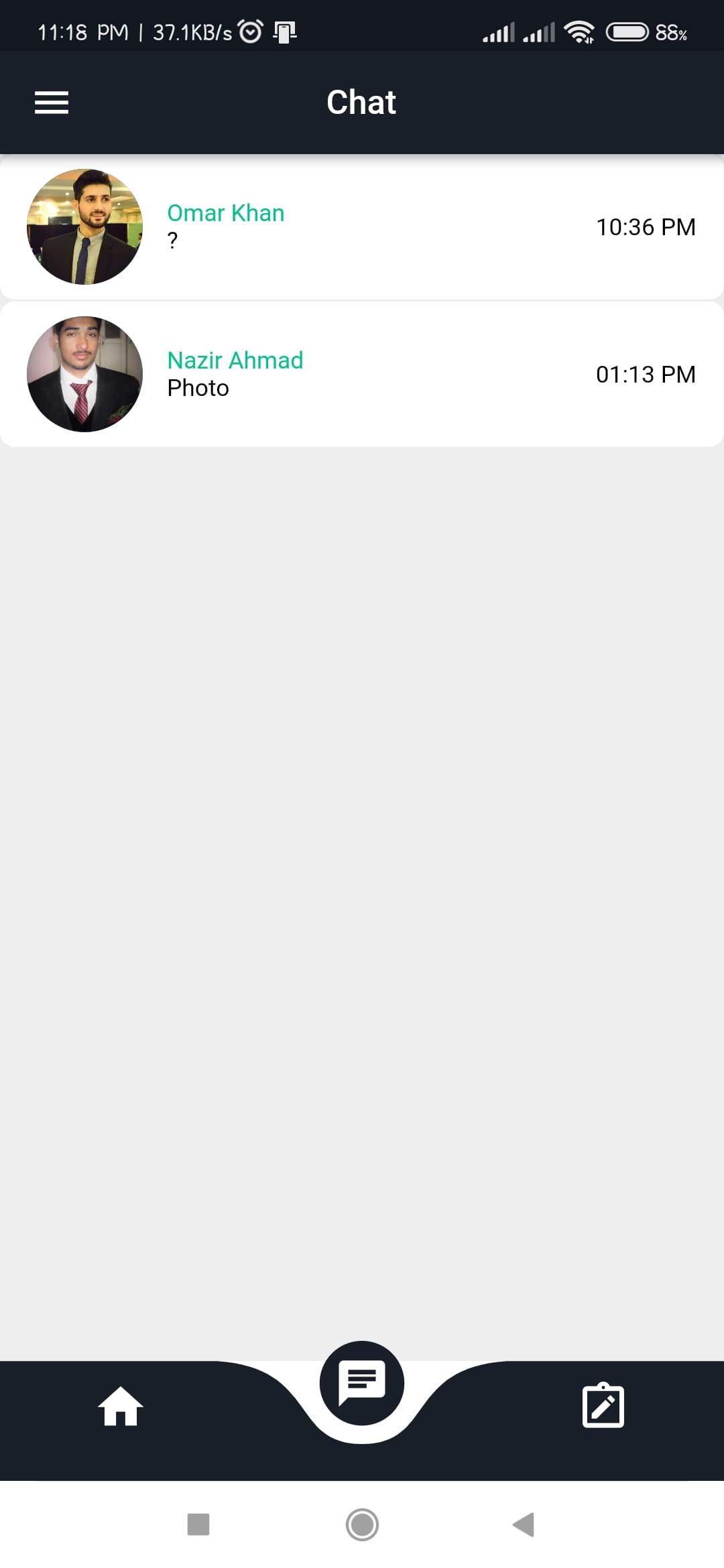

1). Real-time chat messaging: Tax advisors and clients can communicate with each other in real time using chat messaging.

2). File sharing using a scanner: Tax advisors and clients can share files with each other using the platform's built-in scanner.

3). Tax advisor side file management: Tax advisors can manage their files in a secure and organized way using the platform's file management system.

The platform also includes a number of features that are designed to improve the user experience, including:

1). User-friendly interface: The platform has a user-friendly interface that is easy to use for both tax advisors and clients.

2). Secure authentication: The platform uses secure authentication to protect user data.

The Tax Copilot platform has the potential to benefit a number of stakeholders, including:

1). Tax advisors: Tax advisors can use the platform to improve their communication with clients and manage their files more efficiently.

2). Clients: Clients can use the platform to easily connect with tax advisors, communicate with them about their taxes, and share documents.